The current climate policy has failed.

We only need to take a sober and honest look at the history of failure of all our previous efforts to reduce emissions quickly to know where we are heading within our economic system, which is programmed for higher, faster, further. Of course, we have achieved some success in the past, but far too slowly and far too little to adequately address the crisis. And there is no indication that the chosen measures could change this any time soon. This is confirmed by the IPCC, the latest UN climate report and the Expert Council on Climate Change.

source: IPCC AR6

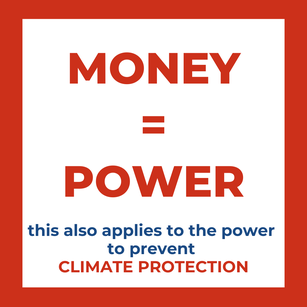

One of the reasons for this is that attempts are being made to map climate protection within the monetary system, but this has countervailing disadvantages. Why is this the case?

Corporations and large fortunes influence the government in order to influence political decisions in a way that is favorable to their purposes. On the one hand, because they want to maintain the basis of fossil business models for as long as possible - and on the other, because they are reluctant to invest in the green transformation.

Wouldn't it therefore be better to decouple climate protection from the monetary system and, for example, control it via personal emissions budgets using a complementary carbon resource currency? One of the reasons for this is that attempts are being made to map climate protection within the monetary system, but this has countervailing disadvantages. Why is this the case?

Our consumption is significantly linked to the emission of climate-damaging greenhouse gases, at least until the industry provides us with sufficient climate-friendly alternatives.

Why isn't it doing this?

Because it can still produce fossil fuels comparatively cheaply and pass on the surcharges for the certificates purchased at auction and the CO2 pricing to us end consumers. This places a disproportionate burden on lower-income households in particular, and contributes to further widening the wealth gap, which generates a further acceptance problem. The hoped-for effect of reducing the purchase of climate-damaging products falls far short of expectations.

An ecological basic income by means of a complementary carbon resource currency ECO (Earth Carbon Obligation) could be a socially just solution. After all, if we pay for our individual CO2 consumption via a personal emissions budget, we naturally favor things that are produced with less fossil energy. We therefore reward manufacturers who already produce in a climate-friendly way and automatically exert the necessary pressure on everyone else to follow suit.

The industry is now INTRINSICALLY motivated to transform itself because it produces what we can buy with our limited budgets. In this way, all the climate-friendly things that we need to meet our budgetary requirements are produced much more quickly.

At the moment, the economy and the environment are treated as separate systems, which is a big problem. This is because they compete with each other and the economy always wins in the end. This is an inherent problem of our current economic system, which is fixated on the pursuit of profit and the overuse of natural resources.

This is why we cannot solve the climate crisis within the existing monetary system.

The complementary currency ECO functions as a CO2e-equivalent and could be a possible way out of this dilemma. It would be made available to all citizens as a free, monthly ecological basic income - in the same amount for everyone. That would be fair and therefore acceptable to the majority. This would then pay for individual fossil-based consumption. In this way, the ecological framework conditions are created within which everyone can move freely.

The need for prosperity results, among other things, from the interest effect and the desire to generate a profit from capital investments. In addition to the operating costs of a value-creating company, the expected interest of the investor must also always be generated. In addition to amortizing the company's own operating costs, it is therefore essential to generate a further item, namely capital gains. This makes the manufactured products or services more expensive and leads to a constant, self-accelerating, immanent upward spiral of prices. Growth is inevitable within this system so that it can continue to exist. Unregulated, this effect also accelerates increasing economic inequality, as wealth continues to grow through capital investments (without performance!).

Furthermore, this economic system is toxic for ecosystems, because continuous growth on a planet with finite resources is impossible and must inevitably reach its limits - which is what is actually happening right now. However, this mechanism is largely legitimized by law, because all market participants who overexploit natural resources operate within the legal framework. Nobody is really doing anything illegal. This applies to Exxon on a large scale, just as it does to the citizen who flies to the Maldives three times a year.

In order to implement an effective, socially liberal and fair climate policy, it must therefore be decoupled from the monetary system.

Why is that?

Since the introduction of the EURO, the money supply has already quadrupled!

So how can a generally limitless means of payment be used to represent a limited resource such as the atmosphere?

Because the money supply of established currencies can be expanded as required and is in fact being expanded continuously. Moreover, from an economic point of view, it is not very convincing to try to solve the climate problem with money, especially in phases of high inflation.

A limited parallel currency is therefore inevitably needed to decouple climate policy from the monetary system.

A rebound effect occurs when efficiency increases reduce the costs of products or services, but these are ultimately consumed more as a result - the original savings are thus partially canceled out. In relation to the climate crisis, there has certainly been progress in the expansion of renewables, but their efficiency is largely offset by growth. Another effect is that money saved by cutting back or doing without or using more efficient technologies in one place is usually spent again elsewhere - e.g. on an additional vacation. This means that potential savings continue to drive the growth spiral.

The rebound effect thus significantly hinders the functioning of a climate policy system that attempts to solve climate protection within the monetary system.

CONCLUSION

We should finally acknowledge all these effects honestly and switch to a system that consistently assigns things their ecological value and, through a fair allocation of the remaining emissions, enables us to use and distribute only those resources to each individual citizen that are actually still available to us as a society.

Such a paradigm shift is exactly what we need if we are to make real progress. The transition from sector-level emissions trading to a citizen-level system could also make accountability much more personal and effective. Implementation requires a complementary carbon resource currency that functions as a CO2e equivalent. It would be made available to all citizens as a free, monthly ecological basic income - in the same amount for everyone. That is fair and therefore acceptable to the majority. This would pay for individual fossil-based consumption. In this way, the ecological framework conditions are created within which everyone can move freely.

The non-profit organization for sustainable economics SaveClimate.Earth describes how such an alternative model could initially be introduced at EU level in its “Exit Strategy Climate Currency ECO”.